Page 60 - BKT Annual Report 2024 EN

P. 60

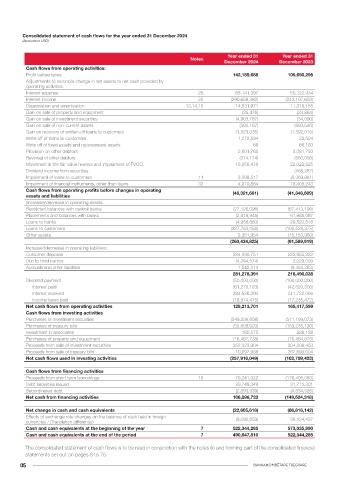

Consolidated statement of changes in equity for the year ended 2024 Consolidated statement of changes in equity for the year ended 2024

(Amounts in USD) (Amounts in USD)

Fair value Fair value

Legal Translation reserve and Retained

Share capital Total Legal Translation reserve and Retained

Reserve reserve impairment earnings Share capital Reserve reserve impairment earnings Total

of FVOCI of FVOCI

Balance as at 31 December 300,000,000 60,093,852 4,182,671 (28,093,813) 207,659,770 543,842,480

2022 Balance as at 31 December 300,000,000 72,819,171 5,028,839 (6,071,188) 265,212,144 636,988,966

Transactions with owners 2023

recorded directly in equity Transactions with owners

recorded directly in equity

Contributions by and

distributions to owners Contributions by and

distributions to owners

Creation of legal reserves - 3,906,700 - - (3,906,700) -

Creation of legal reserves - 4,072,511 - - (4,702,511) -

Adjustment for translation of - 8,818,619 - - (8,818,619) -

legal reserve Adjustment for translation of

legal reserve - (149,568) - - 149,568 -

Dividend payable - - - (50,000,000) (50,000,000)

Increase in share capital 50,000,000 - - - (50,000,000) -

Appropriation of year 2022 - - (4,182,671) - (4,182,671)

translation difference Dividend payable - - - (50,000,000) (50,000,000)

Adjustment of retained earnings Transfer of revaluation surplus - - - - - -

with December 2023 year end - - - - 25,232,492 25,232,492

exchange rate Appropriation of year 2023 - - (5,028,839) - 5,028,839 -

translation difference

Total transactions with - 12,725,319 (4,182,671) - (33,310,156) (24,767,508)

owners recorded in equity Adjustment of retained earnings

with December 2024 year end - - - - (8,967,920) (8,967,920)

exchange rate

Comprehensive income for

the year Total transactions with 50,000,000 3,922,943 (5,028,839) - (107,862,024) (58,967,920)

owners recorded in equity

Net profit for the year - - - - 90,862,530 90,862,530

Comprehensive income for

Other comprehensive the year

income, net of income tax

Net profit for the year - - - - 121,682,275 121,682,275

Net change in fair value reserve - - - 10,630,451 - 10,630,451

Net change in impairment of - - - 11,392,174 - 11,392,174

FVOCI Other comprehensive

income, net of income tax

Foreign currency translation - - 5,028,839 - - 5,028,839

differences Net change in fair value reserve - - - 7,483,959 - 7,483,959

Total other comprehensive - - 5,028,839 22,022,625 - 27,051,464 Net change in impairment of

income FVOCI - - - 7,572,517 - 7,572,517

Total comprehensive income - - 5,028,839 22,022,625 90,862,530 117,913,994 Foreign currency translation

for the year differences - - (1,904,175) - - (1,904,175)

Balance as at 31 December 300,000,000 72,819,171 5,028,839 (6,071,188) 265,212,144 636,988,966 Total other comprehensive

2023 income - - (1,904,175) 15,056,476 - 13,152,301

Total comprehensive income - - (1,904,175) 15,056,476 121,682,275 134,834,576

The consolidated statement of changes in equity is to be read in conjunction with the notes to and forming part of for the year

the consolidated financial statements set out on pages 6 to 75.

Balance as at 31 December 350,000,000 76,742,114 (1,904,175) 8,985,288 279,032,395 712,855,622

2024

The consolidated statement of changes in equity is to be read in conjunction with the notes to and forming part of

the consolidated financial statements set out on pages 6 to 75.

03 BANKA KOMBËTARE TREGTARE