Page 9 - BKT Annual Report 2024 EN

P. 9

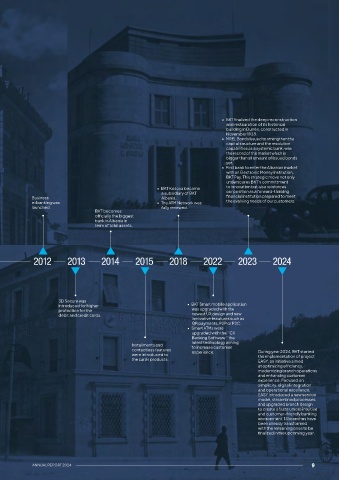

• BKT finalized the deep reconstruction

and restauration of its historical

building in Durrës, constructed in

November 1928.

• MREL Bonds issued to strengthen the

capital structure and the resolution

capabilities as a systemic bank, was

the record of the market which is

bigger than all amount of issued bonds

yet.

• First bank to enter the Albanian market

with an Electronic Money Institution,

BKT Pay. This strategic move not only

underscores BKT’s committment

• BKT Kosova became to innovation but also reinforces

a subsidiary of BKT our position as a forward-thinking

Business Albania. financial institution prepared to meet

e-banking was • The ATM Network was the evolving needs of our customers.

launched. fully renewed.

BKT becomes

officially the biggest

bank in Albania in

term of total assets.

2012 2013 2014 2015 2018 2022 2023 2024

3D Secure was

introduced for higher • BKT Smart mobile application

protection for the was upgraded with the

debit and credit cards. newest UX design and new

innovative feautures such as

QR payments, P2P or P2C.

• Smart ATMs were

upgraded with the ‘’CX

Banking Software’’ the

Installments and latest technology aiming

to increase customer

contactless features experience. During year 2024, BKT started

were introduced to the implementation of project

the cards products. EASY, an initiative aimed

at optimizing efficiency,

modernizing branch operations

and enhancing customer

experience. Focused on

simplicity, digital integration

and operational excellence,

EASY introduced a new service

model, streamlined processes

and upgraded branch design

to create a faster, more intuitive

and customer-friendly banking

environment. 13 branches have

been already transformed

with the remaining ones to be

finalized in the upcoming year.

ANNUAL REPORT 2024 9