Page 121 - BKT Annual Report 2024 EN

P. 121

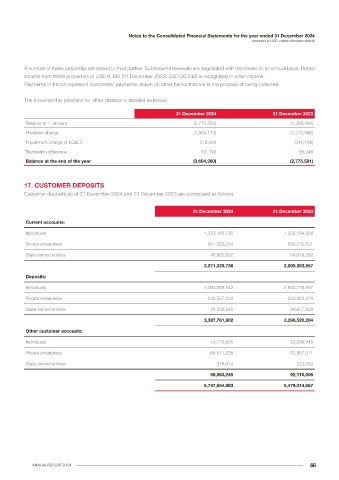

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

14. INTANGIBLE ASSETS

The classification of retail loans by type is as follows:

31 December 2024 31 December 2023 Intangible assets as of 31 December 2024 and 31 December 2023 are composed as follows:

USD % USD %

Home purchase 552,056,296 56% 483,814,053 57% Software

Super Loan 239,560,063 25% 176,807,560 21% Gross value

Overdraft and credit cards 34,510,209 4% 30,954,792 4% At 1 January 2023 25,657,809

Shop purchase 24,712,473 3% 21,604,711 3% Additions 10,068,832

Home improvement 19,915,591 2% 20,215,656 3% Translation difference 4,296,845

Home reconstruction 7,231,382 1% 7,501,644 1% At 31 December 2023 40,023,486

Car purchase 6,508,903 1% 5,549,189 1%

Technical equipment 671,904 1% 1,479,512 1%

Other types 81,493,069 7% 73,913,556 9% Additions 7,691,099

966,659,890 100% 821,840,673 100% Translation difference (202,379)

At 31 December 2024 47,512,206

12. INVESTMENT IN ASSOCIATES

Accumulated depreciation

Investment in associates of USD 738,255 (31 December 2023: USD 934,512) represents: At 1 January 2023 (18,222,872)

Charge for the year (4,538,532)

a) The equivalent amount of an investment of EUR 1,199,600 (equivalent of USD 1,249,106) into the share capital of Albania Leasing Translation difference (3,441,047)

Sh.a (the “Company”) at a participation ratio of 29.99%, decreased to recognise the Bank’s share of the accumulated loss at USD At 31 December 2023 (26,202,451)

632,910 (31 December 2023: USD 537,344). The Company was established in August 2, 2013 (inception date) as a Joint Stock

Company. The Company obtained the license from the Bank of Albania on April 21, 2014 and started its leasing activity in June 2014

Charge for the year (6,439,287)

Translation difference 204,393

b) The BKT Kosova’s equivalent amount of an investment of TRY 4,293,013 (equivalent of USD 122,059) into the share capital of

At 31 December 2024 (32,437,345)

“Mükafat Portföy Yönetimi A.Ş.” at participation rate of 20%.

Net book value

13. PROPERTY AND EQUIPMENT At 1 January 2023 7,434,937

Property and equipment as at 31 December 2024 and 31 December 2023 are composed as follows: At 31 December 2023 13,821,035

Land, buildings and Vehicles and Computers and Office At 31 December 2024 15,074,861

leasehold improvements other equipment electronic equipment equipment Total

Gross value

At 1 January 2023 42,897,402 8,430,690 35,808,923 3,133,197 90,270,212 Intangible assets represent primarily the upgraded Bank’s operating and accounting system, and the licences and software for providing

Additions 954,350 1,142,442 17,918,448 286,070 20,301,310 internet and mobile banking services.

Disposals / transfers (11,803,571) (23,202) (7,640,040) (37,693) (19,504,506)

Translation difference 4,094,157 935,642 1,029,639 369,926 6,429,364 15. RIGHT OF USE ASSET & LEASE LIABILITY

At 31 December 2023 36,142,338 10,485,572 47,116,970 3,751,500 97,496,380

The Bank has applied IFRS 16 using the modified retrospective approach. At lease commencement date, the Bank recognises a

Additions 4,053,738 2,405,270 9,576,911 174,822 16,210,741 right-of-use asset and a lease liability on the balance sheet. The right-of-use asset is measured at cost, which is made up of the initial

Disposals / transfers (1,459,304) (1,138,619) (11,037,308) (179,373) (13,814,604) measurement of the lease liability, any initial direct costs incurred by the Bank, an estimate of any costs to dismantle and remove

Translation difference (1,167,360) (189,472) (605,497) (51,322) (2,013,651) the asset at the end of the lease, and any lease payments made in advance of the lease commencement date (net of any incentives

At 31 December 2024 37,569,412 11,562,751 45,051,076 3,695,627 97,878,866

received).

Accumulated depreciation

At 1 January 2023 (13,139,066) (7,203,125) (24,883,559) (2,783,662) (48,009,412) The Bank depreciates the right-of-use assets on a straight-line basis from the lease commencement date to the earlier of the end of

Charge for the year (611,175) (638,860) (2,578,355) (166,306) (3,994,696) the useful life of the right-of-use asset or the end of the lease term. At the commencement date, the Bank measures the lease liability

Disposals / write offs 2,711,105 1,878 443,393 36,145 3,192,521 at the present value of the lease payments unpaid at that date, discounted using the interest rate implicit in the lease if that rate is

Translation difference (1,542,240) (865,660) (2,370,164) (338,784) (5,116,848)

At 31 December 2023 (12,581,376) (8,705,767) (29,388,685) (3,252,607) (53,928,435) readily available or the Bank’s incremental borrowing rate. The rate used for calculation of the RoU asset and Lease liability has taken

into consideration the term, FX denomination, risk associated with the Bank, security, risk associated with the asset and economic

Charge for the year (706,607) (663,956) (3,474,822) (195,177) (5,040,562) environment.

Disposals / write offs - 357,338 3,656,118 179,305 4,192,761

Translation difference 240,050 172,324 512,435 48,381 973,190

At 31 December 2024 (13,047,933) (8,840,061) (28,694,954) (3,220,098) (53,803,046) The Bank uses the EUR 10,000 as a threshold and simultaneously analyses the nature of the asset in order to assess whether a leased

asset qualifies for the low-value asset exemption. The types of assets that qualify for the low-value asset exemption might change over

Net book value time if, due to market developments, the price of a particular type of asset changes. The Bank has elected to account for short-term

At 1 January 2023 29,758,336 1,227,565 10,925,364 349,535 42,260,800 leases and leases of low-value assets using the practical expedients. Instead of recognising a right-of-use asset and lease liability, the

At 31 December 2023 23,560,962 1,779,805 17,728,285 498,893 43,567,945 payments in relation to these are recognised as an expense in profit or loss on a straight-line basis over the lease term.

At 31 December 2024 24,521,479 2,722,690 16,356,122 475,529 44,075,820

As at 31 December 2024 the gross value of the assets which were fully depreciated and still in use was USD 48,918,739 (2023: USD 49,368,405).

ANNUAL REPORT 2024 64