Page 122 - BKT Annual Report 2024 EN

P. 122

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

The recognised right-of-use assets relate to the following types of assets: A number of these properties are leased to third parties. Subsequent renewals are negotiated with the lessee on an annual basis. Rental

income from these properties of USD 6,188 (31 December 2023: USD 26,542) is recognised in other income.

31 December 2024 31 December 2023

Payments in transit represent customers’ payments drawn on other banks that are in the process of being collected.

Buildings 15,211,167 15,263,559

Total 15,211,167 15,263,559 The movement in provision for other debtors is detailed as below:

The depreciation expenses of right-of-use assets are amounting at USD 3,052,122 for the financial year 2024 (USD 2,784,926 for the 31 December 2024 31 December 2023

financial year 2023). Balance at 1 January (2,775,581) (1,288,484)

Provision charge (1,504,170) (1,210,986)

The lease liabilities are secured by the related underlying assets. Future minimum lease payments are presented as follows:

Impairment charge of LG&LC 518,298 (341,159)

Translation difference 157,193 65,048

31 December 2024 Less than 1 year Over 1 year Total

Lease payments 2,808,741 14,343,327 17,152,068 Balance at the end of the year (3,604,260) (2,775,581)

Finance charges (363,172) (2,833,721) (3,196,893)

Net present values 2,445,569 11,509,606 13,955,175

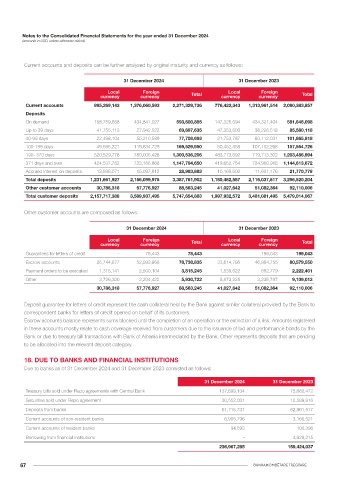

17. CUSTOMER DEPOSITS

31 December 2023 Less than 1 year Over 1 year Total Customer deposits as of 31 December 2024 and 31 December 2023 are composed as follows:

Lease payments 2,875,022 15,241,065 18,116,087

Finance charges (325,218) (3,608,061) (3,933,279)

31 December 2024 31 December 2023

Net present values 2,549,804 11,633,004 14,182,808

Current accounts:

Individuals 1,373,166,790 1,222,194,954

16. OTHER ASSETS

Other assets as of 31 December 2024 and 31 December 2023 are as follows: Private enterprises 851,300,254 803,570,621

State owned entities 46,862,692 64,618,282

31 December 2024 31 December 2023

Assets acquired through legal process, net 33,240,417 37,827,990 2,271,329,736 2,090,383,857

Payments in transit 10,494,283 7,786,313 Deposits:

Prepaid expenses 4,518,813 4,943,512

Inventory 3,157,061 2,635,814 Individuals 3,063,368,142 2,950,778,997

Administration costs receivable from borrowers 1,721,987 1,711,748 Private enterprises 245,557,220 250,863,279

Advances to suppliers 86,364 403,937

Income tax receivable - 3,847,163 State owned entities 78,836,540 94,877,928

Other debtors 3,312,101 2,979,487 3,387,761,902 3,296,520,204

56,531,026 62,135,964

Other customer accounts:

Less allowance for impairment (3,604,260) (2,775,581)

52,926,766 59,360,383 Individuals 19,775,605 23,899,945

Private enterprises 68,571,226 67,987,011

Assets acquired through legal processes represent the repossessed collaterals of some unrecoverable loans, the ownership of which

was taken on behalf of the Bank. Repossessed collateral represents real estate assets acquired by the Bank in settlement of overdue State owned entities 216,414 223,050

loans. The Bank expects to dispose of the assets in the foreseeable future. The Bank has established an Asset Sale Committee, 88,563,245 92,110,006

responsible for the disposal of these assets.

5,747,654,883 5,479,014,067

The assets do not meet the criteria of non-current assets held for sale, and are classified as inventories in accordance with IAS 2

“Inventories”. The assets were initially recognised at fair value when upon acquision. These assets are measured at the lower of their

carrying amount and fair value less costs to sell. The Bank has recognized an impairment amount of USD 18,745,524 (2023: USD

16,436,805) to the total gross amount of USD 51,982,941 (2023: USD 54,264,795).

65 BANKA KOMBËTARE TREGTARE