Page 113 - BKT Annual Report 2024 EN

P. 113

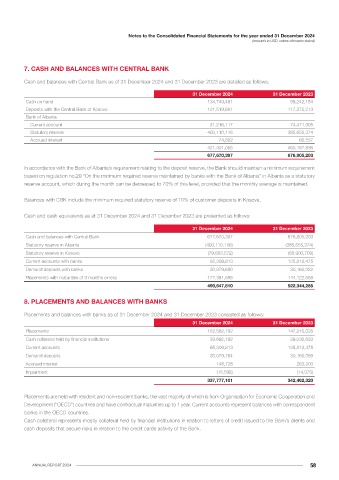

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

• documentation of controls and procedures 6. SEGMENTAL REPORTING

• requirements for the periodic assessment of operational risks faced, and the adequacy of controls and procedures to address

the risks identified

31 December 2024 31 December 2023

• requirements for the reporting of operational losses and proposed remedial action

Geographical Segments

• development of contingency plans Albania Kosovo Consolidated Albania Kosovo Consolidated

• training and professional development

Assets

• ethical and business standards

• risk mitigation, including insurance where this is effective. Cash and balances with 487,413,629 190,256,768 677,670,397 507,206,616 169,598,587 676,805,203

Central Bank

Compliance with internal standards is supported by a programme of periodic reviews undertaken by Internal Audit. The results of

Placement and balances

Internal Audit reviews are discussed with the management of the business unit to which they relate, with summaries submitted to the with banks 197,773,855 141,386,086 337,777,101 213,589,572 130,221,092 342,462,320

Audit Committee and senior management of the Bank. Intragroup Receivables 33,987,651 467,307 - 34,855,827 36,452 -

Investment securities 3,406,183,798 249,066,333 3,655,250,131 3,163,753,746 252,493,618 3,416,247,364

Loans to banks 89,788,370 49,023,676 138,812,046 80,634,375 54,196,163 134,830,538

(f) Capital management

The Bank’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to sustain future Loans to customers 1,099,865,003 809,181,479 1,909,046,482 1,023,149,690 670,879,294 1,694,028,984

development of the business. The impact of the level of capital on shareholders’ return is also recognised and the Bank recognises the Investment in associates/ 33,528,440 122,059 738,255 35,606,711 145,324 934,512

subsidiaries

need to maintain a balance between the higher returns that might be possible with greater gearing and the advantages and security

afforded by a sound capital position. There have been no material changes in the Bank’s management of capital during the period. Property and equipment 26,368,183 17,707,637 44,075,820 26,013,962 17,553,983 43,567,945

Intangible assets 14,173,824 901,037 15,074,861 13,014,205 806,830 13,821,035

Regulatory capital

Right-of-use assets 10,738,295 4,472,872 15,211,167 10,965,107 4,298,452 15,263,559

The Bank monitors the adequacy of its capital using, among other measures, the rules and ratios established by the Albanian regulator,

the Bank of Albania (“BoA”), which ultimately determines the statutory capital required to underpin its business. The new regulations Deferred tax assets 8,264,450 826,779 9,091,229 9,461,997 1,877,040 11,339,037

“On the capital adequacy ratio” and “On the regulatory capital” entered into force in 2015 are issued pursuant to Law No. 8269 date Other assets 44,282,058 8,644,708 52,926,766 50,755,898 8,604,485 59,360,383

23.12.1997 “On the Bank of Albania”, and Law No. 9662 date 18.12.2006 “On Banks in the Republic of Albania”. Total assets 5,452,367,556 1,472,056,741 6,855,674,255 5,169,007,706 1,310,711,320 6,408,660,880

Liabilities and shareholder’s equity

Capital Adequacy Ratio

The Capital Adequacy Ratio is the proportion of the regulatory capital to risk weighted exposures, calculated as the sum of the risk- Liabilities

weighted exposure amounts, on- and off-balance sheet for credit risk and for credit counterparty risk, capital requirement for market Customer deposits 4,607,747,995 1,141,289,728 5,747,654,883 4,428,072,615 1,052,289,796 5,479,014,067

and operational risk. Due to banks and financial 137,613,175 99,354,110 236,967,285 106,951,814 52,472,223 159,424,037

The minimum Regulatory Capital Ratio against the risk weighted exposures required by Bank of Albania is 12%. The minimum Tier 1 institutions

Capital Ratio is 9.0% and the minimum Common Equity Tier 1 Ratio is 6.75%. Intragroup Payables 467,307 33,987,651 - 36,452 34,855,827 -

In December 2024, BKT has reported the following consolidated ratios: Due to third parties 3,812,079 - 3,812,079 8,134,168 4,678 8,138,846

- Regulatory Capital Ratio 18.75% (December 2023: 17.60%); Accruals and other liabilities 22,543,122 5,246,317 27,789,439 19,664,633 4,993,028 24,657,661

- Tier 1 Capital Ratio 17.93% (December 2023: 16.52%);

Lease Liability 9,334,500 4,620,675 13,955,175 9,733,967 4,448,841 14,182,808

- Common Equity Tier 1 Ratio 17.93% (December 2023: 16.52%).

Debt securities issued 63,543,076 - 63,543,076 34,072,463 - 34,072,463

Based on the regulation of BoA nr. 4/2017 “On the consolidated supervision” the Bank should also monitor its capital adequacy ratio

on a stand-alone basis. The same minimum regulatory ratios mentioned above are applied. Subordinated debt 26,122,033 22,974,663 49,096,696 27,764,038 24,417,994 52,182,032

In December 2024, BKT has reported the following stand-alone ratios: Total liabilities 4,871,183,287 1,307,473,144 6,142,818,633 4,634,430,150 1,173,482,387 5,771,671,914

- Regulatory Capital Ratio 21.55% (December 2023: 20.06%); Shareholder’s equity

- Tier 1 Capital Ratio 21.33% (December 2023: 19.58%);

Share capital 350,000,000 32,279,334 350,000,000 300,000,000 34,280,179 300,000,000

- Common Equity Tier 1 Ratio 21.33% (December 2023: 19.58%).

Legal reserve 76,742,114 - 76,742,114 72,819,171 - 72,819,171

Risk-Weighted Assets (RWAs) Translation reserve (1,158,060) (746,115) (1,904,175) 4,501,803 527,036 5,028,839

For calculation of credit risk, exposures, on- and off-balance sheet are classified in 15 exposure classes. In general terms, client/ Fair value reserve and

issuer type, loan destination and collateral are the main determinants of the exposure class. Each exposure class has its own specific impairment of FVOCI 8,387,285 598,003 8,985,288 219,669 (6,290,857) (6,071,188)

requirements on how to assess the appropriate risk weight and respective risk weighted exposures. For credit risk and counterparty Retained earnings 147,212,930 132,452,375 279,032,395 157,036,913 108,712,575 265,212,144

risk is applied the Standardised Approach. Market risk capital requirements are calculated in case the Bank has a Trading portfolio Total shareholder’s equity 581,184,269 164,583,597 712,855,622 534,577,556 137,228,933 636,988,966

that fulfils the requirements defined by the regulation and/ or a total net open currency position that is larger than the defined minimum

Total liabilities and

threshold. Operational risk capital requirement is calculated based on the Basic Indicator Approach. shareholder’s equity 5,452,367,556 1,472,056,741 6,855,674,255 5,169,007,706 1,310,711,320 6,408,660,880

ANNUAL REPORT 2024 56