Page 108 - BKT Annual Report 2024 EN

P. 108

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

Exposure to liquidity risk 31 December 2023 Lek USD Euro Other Total

One of the key ratios used by the Bank for managing liquidity risk, which is required by Bank of Albania (BoA) also, is the ratio of total Assets (In USD equivalent)

liquid assets to total short-term liabilities on a daily basis. Based on the regulation No.71 dated 14.10.2009 “Liquidity risk management Cash and balances with Central Bank 215,431,044 24,375,937 406,289,022 30,709,200 676,805,203

policy” the total liquidity ratio should be at a minimum of 20%, whereas the minimum of individual ratios for local and foreign currencies Placements and balances with banks 485,883 68,000,574 253,398,411 20,577,452 342,462,320

(FX) should be at at 15% and 20% respectively. Investment securities 1,277,530,509 512,564,120 1,538,773,083 87,379,652 3,416,247,364

As per this regulation, article 19 point 4, liquid assets are considered: cash balance, current accounts with BoA including mandatory Loans to banks - 26,580,192 108,250,346 - 134,830,538

reserve, T-bills and securities according to their remaining maturity and ability to turn into liquidity, where the non-resident counterparties’ Loans to customers 634,721,230 55,180,360 1,004,127,394 - 1,694,028,984

balances are discounted with the respective haircuts according to international credit rating. Short-term liabilities are considered all Other assets 4,650,423 (215,733) 5,234,531 32,746 9,701,967

liabilities with remaining maturity up to one year. Total assets 2,132,819,089 686,485,450 3,316,072,787 138,699,050 6,274,076,376

Details of the reported Bank ratio at the reporting dates were as follows: Foreign exchange contracts 10,755,269 10,159,265 107,121,779 456,741 128,493,054

31-Dec-2024 31-Dec-2023 Liabilities

Total Liquid Assets/Total Short Term Liabilities Ratio 40.91% 40.59% Customer deposits 1,997,932,572 219,203,721 3,161,459,029 100,418,745 5,479,014,067

Liquid Assets in local currency/Short Term Liabilities in local currency Ratio 65.05% 67.36% Due to banks and financial institutions 104,625,687 9,512,103 41,915,154 3,371,093 159,424,037

Due to third parties 8,134,168 - 4,678 - 8,138,846

Liquid Assets in foreign currency/Short Term Liabilities in foreign currency Ratio 26.58% 25.06%

Accruals and other liabilities 7,106,428 4,879,651 4,462,038 109,205 16,557,322

Lease liabilities 741,391 164,301 13,277,116 - 14,182,808

(d) Market risk Debt securities issued - - 34,072,463 - 34,072,463

1) Foreign currency risk Subordinated debt - - 52,182,032 - 52,182,032

Total liabilities 2,118,540,246 233,759,776 3,307,372,510 103,899,043 5,763,571,575

Foreign currency risk is the risk that the value of financial instruments will fluctuate due to changes in foreign exchange rates. The Foreign exchange contracts 497,711 74,208,130 20,111,236 33,675,977 128,493,054

Bank manages this risk by establishing and monitoring limits on open positions and also by ensuring that these positions remain in Net position (GAP) 28,383,563 388,676,809 95,710,820 1,580,772 514,351,964

compliance with the Bank of Albania guidelines and the Bank’s internal operational covenants. The Bank has procedures in place for

the independent checking of open foreign currency positions. Total assets / Total liabilities 101.34% 226.21% 102.88% 101.15% 108.73%

GAP / FX denominated assets 0.56 0.028 0.0114 0.08

The following tables present the USD equivalent amounts of monetary assets and liabilities by currency as of 31 December 2024 and

Sensitivity analysis

31 December 2023:

Lek depreciates by 10% 35,334,255 8,700,984 143,706 44,178,945

31 December 2024 Lek USD Euro Other Total Lek depreciates by 5% 18,508,419 4,557,658 75,275 23,141,352

Assets (In USD equivalent) Lek appreciates by 5% (20,456,674) (5,037,412) (83,198) (25,577,284)

Cash and balances with Central Bank 173,711,310 26,539,009 445,693,912 31,726,166 677,670,397 Lek appreciates by 10% (43,186,312) (10,634,536) (175,641) (53,996,489)

Placements and balances with banks 1,499,396 111,472,760 207,118,109 17,686,836 337,777,101

Investment securities 1,461,203,365 505,568,063 1,608,922,388 79,556,315 3,655,250,131 2) Interest rate risk

Loans to banks - 38,479,031 100,333,015 - 138,812,046

Loans to customers 710,940,851 50,799,872 1,147,305,759 - 1,909,046,482 Interest rate risk is the risk that the value of financial instruments will fluctuate due to changes in market interest rates. The Treasury

Other assets 4,117,135 (54,261) 9,410,539 29,552 13,502,965 Department of the Bank manages the interest rate risk through monitoring the market conditions and taking necessary re-pricing or

Total assets 2,351,472,057 732,804,474 3,518,783,722 128,998,869 6,732,059,122 reallocation decisions with the approval of the Asset and Liability Committee. The sensitivity analysis has been determined based on

Foreign exchange contracts 5,733,078 13,725,666 72,792,326 2,692,758 94,943,828

the exposure to interest rates for both financial assets and financial liabilities assuming that their amounts outstanding at the reporting

Liabilities date were outstanding for the whole year.

Customer deposits 2,157,717,387 217,355,804 3,267,707,037 104,874,655 5,747,654,883

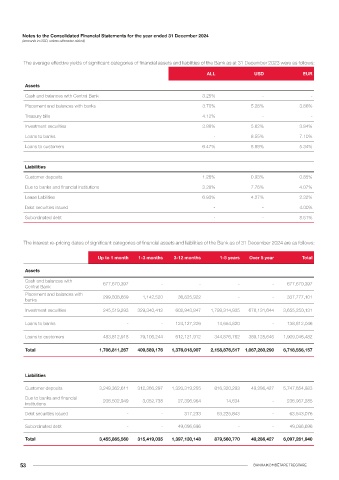

Due to banks and financial institutions 133,100,313 25,191,560 76,449,411 2,226,001 236,967,285 The average effective yields of significant categories of financial assets and liabilities of the Bank as of 31 December 2024 are as follows:

Due to third parties 3,812,079 - - - 3,812,079

Accruals and other liabilities 9,493,790 5,003,493 5,169,148 79,110 19,745,541

Lease liabilities 900,861 234,951 12,819,363 - 13,955,175 ALL USD EUR

Debt securities issued - - 63,543,076 - 63,543,076 Assets

Subordinated debt - - 49,096,696 - 49,096,696 Cash and balances with Central Bank 2.75% - -

Total liabilities 2,305,024,430 247,785,808 3,474,784,731 107,179,766 6,134,774,735 Placement and balances with banks 3.20% 4.29% 2.90%

Foreign exchange contracts 498,196 49,615,694 21,660,474 23,169,464 94,943,828 Treasury bills 3.54% - -

Net position (GAP) 51,682,509 449,128,638 95,130,843 1,342,397 597,284,387

Investment securities 4.32% 5.55% 3.57%

Total assets / Total liabilities 102.24% 251.02% 102.72% 101.03% 109.59% Loans to banks - 7.99% 4.62%

GAP / FX denominated assets 0.60 0.026 0.0102 0.09 Loans to customers 5.36% 7.36% 5.45%

Sensitivity analysis Liabilities

Lek depreciates by 10% 40,829,876 8,648,258 122,036 49,600,170 Customer deposits 1.25% 0.99% 0.68%

Lek depreciates by 5% 21,387,078 4,530,040 63,924 25,981,042

Lek appreciates by 5% (23,638,349) (5,006,886) (70,652) (28,715,887) Due to banks and financial institutions 2.76% 6.54% 3.16%

Lek appreciates by 10% (49,903,182) (10,570,094) (149,155) (60,622,431) Lease Labilities 5.75% 4.90% 2.64%

Debt securities issued - - 4.12%

Subordinated debt - - 7.22%

51 BANKA KOMBËTARE TREGTARE