Page 105 - BKT Annual Report 2024 EN

P. 105

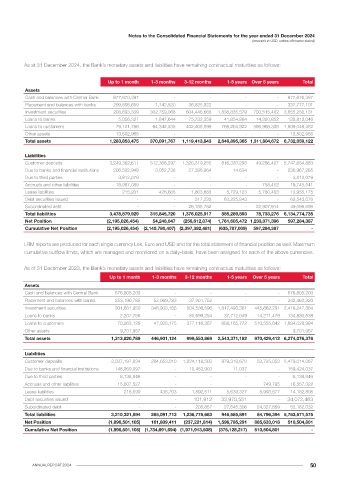

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

Loans with renegotiated terms treasury and other eligible bills are generally unsecured, with the exception of asset-backed securities and similar instruments, which

Loans with renegotiated terms are loans that have been restructured due to deterioration in the borrower’s financial position and where are secured by portfolios of financial instruments.

the Bank has made concessions that it would not otherwise consider.

Once the loan is restructured, its performance is closely monitored for the purpose of impairment testing. The Group’s policies regarding obtaining collateral have not significantly changed during the reporting period and there has been no

significant change in the overall quality of the collateral held by the Group since the prior period.

Set out below are the carrying amounts of loans to customers whose term have been renegotiated and are under monitoring:

FORBORNE LOANS TO CUSTOMERS ACCORDING TO THEIR CREDIT QUALITY AT AMORTISED COST Set out below is an analysis of collateral and credit enhancement obtained during the years:

Total amount of

31 December 2024 Total amount of Loans Forborne Loans Forborne Loans (%) 31 December 2024 Loans to customers

(Permanent modification) Retail Corporate Total Loans

Stage 1 1,814,348,791 5,549,042 0.3% Residential, commercial or industrial

Stage 2 95,066,123 50,619,342 53.2% Property 1,440,634,557 1,866,167,202 3,306,801,759

Stage 3 50,393,745 11,998,302 23.8% Financial assets 72,191,457 1,117,744,391 1,189,935,848

Exposure before impairment 1,959,808,659 68,166,686 3.5% Other 355,020,645 341,512,459 696,533,104

Total 1,867,846,659 3,325,424,052 5,193,270,711

Stage 1 Allowance 14,197,575 58,733 0.4%

Stage 2 Allowance 11,627,695 7,973,664 68.6%

Stage 3 Allowance 24,855,630 3,766,744 15.2% 31 December 2023 Loans to customers

Total net amount 1,909,127,759 56,367,545 3.0% Retail Corporate Total Loans

Residential, commercial or industrial

Discounted value of collateral 3,294,670,321 105,574,156 3.2% Property 1,309,399,510 1,655,454,035 2,964,853,545

Financial assets 66,945,882 1,091,081,252 1,158,027,134

Off Balance Sheet Allowance 81,277 - - Other 269,953,371 261,259,369 531,212,740

Total 1,646,298,763 3,007,794,656 4,654,093,419

FORBORNE LOANS TO CUSTOMERS ACCORDING TO THEIR CREDIT QUALITY AT AMORTISED COST Impaired loans and securities

Total amount of

31 December 2023 Total amount of Loans Forborne Loans Forborne Loans (%) Impaired loans and securities are loans and securities for which the Bank determines that it is probable that it will be unable to collect

(Permanent modification) all principal and interest due according to the contractual terms of the loan / securities agreement(s). The Risk Committee of BKT is

Stage 1 1,565,660,683 2,302,413 0.1% engaged with the grading of the customers and their scoring according to the appropriate categories. It decides on the changes in

Stage 2 131,872,458 72,469,274 55.0% grading and takes the necessary actions according to the monitoring procedures. The Risk Committee grades each loan according

Stage 3 51,073,594 10,404,405 20.4% to these factors:

Exposure before impairment 1,748,606,735 85,176,092 4.9%

• Ability to Pay

Stage 1 Allowance 17,900,687 13,170 0.1% • Financial Condition

Stage 2 Allowance 17,657,724 11,959,319 67.7% • Management ability

Stage 3 Allowance 18,912,613 3,084,572 16.3% • Collateral and Guarantors

Total net amount 1,694,135,711 70,119,031 4.1% • Loan Structure

• Industry and Economics

Discounted value of collateral 2,833,140,573 92,674,443 3.3%

Past due but not impaired loans

Off Balance Sheet Allowance 106,727 - -

Past due but not impaired loans are those loans and securities, in which contractual interest or principal payments are past due, but

the Bank believes that impairment is not appropriate on the basis of the level of security / collateral available and / or the stage of

collection of amounts owed to the Bank.

iv. Collateral and other credit enhancements

The Group employs a range of policies and practices to mitigate credit risk. The most common of these is accepting collateral for funds Allowances for impairment

advanced. The Group has internal policies on the acceptability of specific classes of collateral or credit risk mitigation. The Bank establishes an allowance for impairment losses that represents its estimate of incurred losses in its loan portfolio and other

The Group prepares a valuation of the collateral obtained as part of the loan origination process. This assessment is reviewed periodically. financial assets. It relates to the specific loss component for individually significant exposures.

The Group prepares a valuation of the collateral obtained as part of the loan origination process. This assessment is reviewed periodically. Write-off policy

The principal collateral types for loans and advances are:

The Bank writes off a loan / security balance (and any related allowances for impairment losses) with the decision of the Board of

• Mortgages over residential properties; Directors, in accordance with the regulation of Bank of Albania “On Credit Risk Management”. The write-off decision is taken after

• Financial Assets considering information such as the occurrence of significant changes in the borrower / issuer’s financial position, such that the borrower

• Charges over business assets such as premises, machinery, and accounts receivable; / issuer can no longer pay the obligation, or that proceeds from collateral will not be sufficient to pay back the entire exposure.

Longer-term finance and lending to corporate entities are generally secured; revolving individual credit facilities are generally unsecured.

Collateral held as security for financial assets other than loans and advances depends on the nature of the instrument. Debt securities,

ANNUAL REPORT 2024 48