Page 102 - BKT Annual Report 2024 EN

P. 102

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

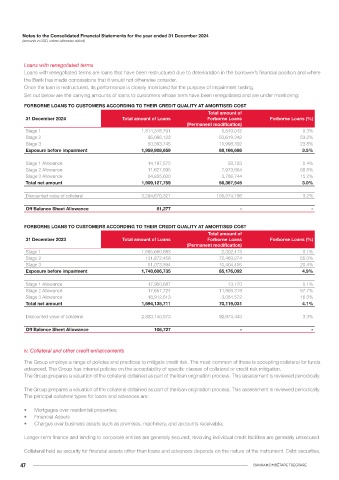

The following table sets out information about the credit quality loans to customers for the retail portfolio in 2024. Unless specifically The following table sets out information about the credit quality loans to customers for the retail portfolio in 2023. Unless specifically

indicated, for financial assets, the amounts in the table represent gross carrying amounts. indicated, for financial assets, the amounts in the table represent gross carrying amounts. .

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST – RETAIL PORTFOLIO DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST – RETAIL PORTFOLIO

Lifetime ECL

Lifetime ECL

31 December 2024 12-month ECL Lifetime ECL not credit-impaired Total 31 December 2023 12-month ECL Lifetime ECL not credit-impaired Total

credit-impaired

credit-impaired

Mortgage Mortgage

Strong 38,447,806 30,571 - 38,478,377 Strong 26,299,810 61,771 - 26,361,581

Satisfactory 382,005,764 9,716,480 328,857 392,051,101 Satisfactory 347,294,005 11,315,466 110,355 358,719,826

Watch list (higher risk) - - 1,619,073 1,619,073 Watch list (higher risk) - - 1,823,943 1,823,943

Defaults - - 3,024,907 3,024,907 Defaults - - 3,373,563 3,373,563

Non Rated 141,707,282 1,513,975 558,629 143,779,886 Non Rated 118,151,128 698,713 - 118,849,841

Total gross amount 562,160,852 11,261,026 5,531,466 578,953,344 Total gross amount 491,744,943 12,075,950 5,307,861 509,128,754

Loss allowance 1,709,326 930,318 1,296,322 3,935,966 Loss allowance 1,688,399 797,604 1,190,394 3,676,397

Carrying amount 560,451,526 10,330,708 4,235,144 575,017,378 Carrying amount 490,056,544 11,278,346 4,117,467 505,452,357

Discounted collateral held for credit impaired assets 698,773,298 19,190,927 12,306,174 730,270,399 Discounted collateral held for credit impaired assets 631,523,243 21,912,426 14,311,759 667,747,428

Consumer Consumer

Strong 16,867,942 54,875 184 16,923,001

Strong 34,941,736 31,479 6,903 34,980,118

Satisfactory 31,663,218 2,393,857 3,525 34,060,600

Satisfactory 47,420,242 1,343,566 276,434 49,040,242

Watch list (higher risk) - - 353,776 353,776

Watch list (higher risk) - - 380,129 380,129

Defaults - - 4,195,815 4,195,815

Defaults - - 4,091,983 4,091,983

Non Rated 237,903,853 1,618,741 24,226 239,546,820

Non Rated 275,812,425 2,323,338 107,957 278,243,720

Total gross amount 286,435,013 4,067,473 4,577,526 295,080,012

Total gross amount 358,174,403 3,698,383 4,863,406 366,736,192

Loss allowance 1,826,399 212,032 2,862,290 4,900,721

Loss allowance 1,088,830 273,774 2,305,022 3,667,626

Carrying amount 284,608,614 3,855,441 1,715,236 290,179,291

Carrying amount 357,085,573 3,424,609 2,558,384 363,068,566

Discounted collateral held for credit impaired assets 253,190,277 5,490,753 3,068,583 261,749,613

Discounted collateral held for credit impaired assets 286,020,534 4,129,473 4,420,185 294,570,192

Credit cards

Credit cards

Defaults - - 1,002,060 1,002,060

Defaults - - 1,395,548 1,395,548

Non Rated 14,547,114 209,310 11,486 14,767,910

Non Rated 16,386,497 760,150 7,903 17,154,550

Total gross amount 14,547,114 209,310 1,013,546 15,769,970

Total gross amount 16,386,497 760,150 1,403,451 18,550,098

Loss allowance 181,784 24,505 620,953 827,242

Loss allowance 166,442 44,438 809,566 1,020,446

Carrying amount 14,365,330 184,805 392,593 14,942,728

Carrying amount 16,220,055 715,712 593,885 17,529,652

Discounted collateral held for credit impaired assets - - - -

Discounted collateral held for credit impaired assets - - - -

OFF BALANCE SHEET

OFF BALANCE SHEET

Credit cards Loss allowance 78,557 78,557

Credit cards Loss allowance 41,781 41,781

45 BANKA KOMBËTARE TREGTARE