Page 97 - BKT Annual Report 2024 EN

P. 97

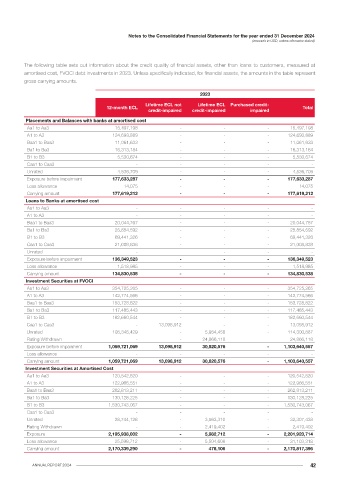

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

The following table sets out information about the aging analyses of loan to customers in 2024 by business lines’ products. The following table sets out information about the aging analyses of loan to customers in 2023 by business lines’ products.

LOANS TO CUSTOMERS AT AMORTISED COST LOANS TO CUSTOMERS AT AMORTISED COST

31 Retail lending 31 Retail lending

December December

2024 Mortgage Consumer Credit cards 2023 Mortgage Consumer Credit cards

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Current 536,937,471 1,912,910 1,096,320 539,946,701 347,106,084 334,953 176,648 347,617,685 15,691,850 157,374 2,718 15,851,942 Current 462,811,209 1,509,883 770,796 465,091,888 274,789,759 465,435 132,109 275,387,303 13,206,961 117 4,887 13,211,965

1 - 30 days 23,514,055 1,237,606 233,042 24,984,703 9,979,489 508,557 150,764 10,638,810 528,205 168,282 219 696,706 1 - 30 days 27,245,335 894,781 478,978 28,619,094 9,818,855 96,521 75,904 9,991,280 1,158,369 (12) 1,545 1,159,902

31 - 90 - 7,180,192 714,536 7,894,728 - 2,581,099 335,758 2,916,857 - 390,056 1,926 391,982 31 - 90 - 8,873,682 590,738 9,464,420 - 3,293,485 138,520 3,432,005 - 184,700 530 185,230

days days

91 - 180 - - 809,872 809,872 - - 739,386 739,386 - - 107,512 107,512 91 - 180 - - 456,514 456,514 - - 253,181 253,181 - - 12,575 12,575

days days

181 - 360 - - 237,653 237,653 - - 413,345 413,345 - - 481,510 481,510 181 - 360 - - 254,279 254,279 - - 287,188 287,188 - - 373,056 373,056

days days

> 361 days - - 1,143,721 1,143,721 - - 742,483 742,483 - - - - > 361 days - - 1,566,162 1,566,162 - - 828,334 828,334 - - - -

Total 560,451,526 10,330,708 4,235,144 575,017,378 357,085,573 3,424,609 2,558,384 363,068,566 16,220,055 715,712 593,885 17,529,652 Total 490,056,544 11,278,346 4,117,467 505,452,357 284,608,614 3,855,441 1,715,236 290,179,291 14,365,330 184,805 392,593 14,942,728

Value of Value of

discounted 698,773,298 19,190,927 12,306,174 730,270,399 286,020,534 4,129,473 4,420,185 294,570,192 - - - - discounted 631,523,243 21,912,426 14,311,759 667,747,428 253,190,277 5,490,753 3,068,583 261,749,613 - - - -

collateral collateral

LOANS TO CUSTOMERS AT AMORTISED COST LOANS TO CUSTOMERS AT AMORTISED COST

Corporate lending Corporate lending

31 Large Corporate SME Corporate Micro Corporate 31 Large Corporate SME Corporate Micro Corporate

December December

2024 Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total 2023 Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Current 651,973,724 54,701,448 129,026 706,804,198 133,256,294 2,936,254 2,436,845 138,629,393 59,704,993 1,223,565 997,473 61,926,031 Current 596,395,496 37,672,515 3,225,125 637,293,136 91,235,662 2,751,431 1,057,119 95,044,212 43,778,229 1,756,325 523,645 46,058,199

1 - 30 days 9,506,252 394,213 2,589,183 12,489,648 6,262,783 1,108,357 542,645 7,913,785 5,690,016 3,199 5,261 5,698,476 1 - 30 days 17,133,518 9,753,112 976,127 27,862,757 6,563,917 328,735 443,215 7,335,867 3,622,686 247,598 109,740 3,980,024

31 - 90 - 6,168,573 - 6,168,573 - 1,240,499 266,970 1,507,469 - 1,191,291 376,659 1,567,950 31 - 90 - 41,137,642 6,343,632 47,481,274 - 3,975,304 482,331 4,457,635 - 1,273,480 409,018 1,682,498

days days

91 - 180 - - 13,990 13,990 - - 389,468 389,468 - - 129,280 129,280 91 - 180 - - - - - - 342,728 342,728 - - 442,432 442,432

days days

181 - 360 - - 106,572 106,572 - - 2,178,517 2,178,517 - - 513,050 513,050 181 - 360 - - - - - - 451,973 451,973 - - 395,653 395,653

days days

> 361 days - - 6,118,147 6,118,147 - - 138,174 138,174 - - 1,219,442 1,219,442 > 361 days - - 8,113,598 8,113,598 - - 561,691 561,691 - - 2,057,658 2,057,658

Total 661,479,976 61,264,234 8,956,918 731,701,128 139,519,077 5,285,110 5,952,619 150,756,806 65,395,009 2,418,055 3,241,165 71,054,229 Total 613,529,014 88,563,269 18,658,482 720,750,765 97,799,579 7,055,470 3,339,057 108,194,106 47,400,915 3,277,403 3,938,146 54,616,464

Value of Value of

discounted 1,510,164,213 101,482,257 37,207,989 1,648,854,459 379,133,218 19,243,917 27,085,654 425,462,789 168,533,352 10,444,456 16,534,674 195,512,482 discounted 1,296,647,142 89,939,636 51,498,858 1,438,085,636 270,915,015 23,973,229 16,821,723 311,709,967 124,852,813 9,822,589 19,172,527 153,847,929

collateral collateral

ANNUAL REPORT 2024 40