Page 92 - BKT Annual Report 2024 EN

P. 92

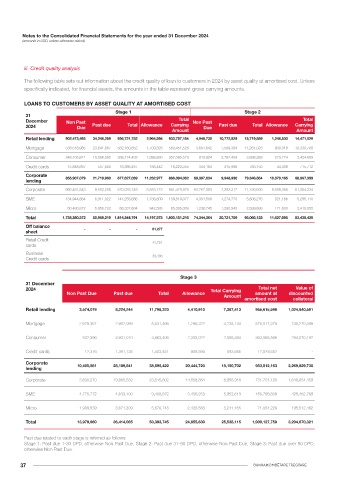

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

The following table sets out the changes in gross carrying amount of financial assets where impairment requirements apply (other than The following table sets out the changes in gross carrying amount of financial assets where impairment requirements apply (other than

loans to customers). loans to customers).

Reconciliation of the accumulated impairment allowance of financial assets where impairment requirements apply Reconciliation of the accumulated impairment allowance of financial assets where impairment requirements apply

(other than loans to customers) (other than loans to customers)

31 December 2024 Due from Banks Investment Securities at FVOCI 31 December 2023 Due from Banks Investment Securities at FVOCI

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 1,533,061 - - 1,533,061 2,694,647 4,965,865 36,755,462 44,415,974 Balance at 1 1,442,318 - - 1,442,318 2,561,734 5,802,980 24,659,086 33,023,800

January 2024 January 2023

Transfer to Stage 1 - - - - - - - - Transfer to Stage 1 (from - - - - - - - -

(from 2 or 3) 2 or 3)

Transfer to Stage 2 - - - - - - - - Transfer to Stage 2 (from - - - - (312,214) 312,214 - -

(from 1 or 3) 1 or 3)

Transfer to Stage 3 - - - - (75,003) - 7,490,122 7,415,119 Transfer to Stage 3 (from - - - - - (3,046,315) 4,500,759 1,454,444

(from 1 or 2) 1 or 2)

New financial assets 400,972 - - 400,972 1,862,506 - 3,009,979 4,872,485 New financial assets 954,106 - - 954,106 432,180 - - 432,180

originated or purchased originated or purchased

Derecognition of (920,753) - - (920,753) (1,000,485) (3,775,027) - (4,775,512) Derecognition of (959,551) - - (959,551) (675,289) - - (675,289)

financial assets financial assets

Reclassification of - - - - - - - - Reclassification of

instruments instruments measured - - - - - - - -

Write-offs - - - - - - - - at FVOCI to amortised

cost

Changes in models/risk (428,603) - - (428,603) (694,221) (471,021) 4,574,351 3,409,109

parameters Write-offs - - - - - - - -

Foreign exchange and (31,452) - - (31,452) (92,831) (223,927) (1,785,310) (2,102,068) Changes in models/risk 56,156 - - 56,156 925,943 1,877,904 6,688,848 9,492,695

parameters

other movements

Allowance 553,225 - - 553,225 2,694,613 495,890 50,044,604 53,235,107 Foreign exchange and 40,032 - - 40,032 (237,707) 19,082 906,769 688,144

at 31 December 2024 other movements

Allowance 1,533,061 - - 1,533,061 2,694,647 4,965,865 36,755,462 44,415,974

at 31 December 2023

31 December 2024 Debt Investment Securities at amortised cost Loan Commitments and financial guarantee contracts

31 December 2023 Debt Investment Securities at amortised cost Loan Commitments and financial guarantee contracts

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 January 13,966,337 - 5,504,606 19,470,943 831,155 20,052 45,342 896,549 Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

2024 Balance at 1 January 4,528,553 2,870,605 3,439,597 10,838,755 522,566 - - 522,566

2023

Transfer to Stage 1 - - - - 18,882 (18,882) - -

(from 2 or 3) Transfer to Stage 1 - - - - - - - -

Transfer to Stage 2 - - - - - - - - (from 2 or 3)

(from 1 or 3) Transfer to Stage 2 - - - - - - - -

Transfer to Stage 3 - - - - - - - - (from 1 or 3)

(from 1 or 2) Transfer to Stage 3 - - - - - - - -

(from 1 or 2)

New financial assets 732,089 - - 732,089 75,240 5,196 - 80,436

originated or purchased New financial assets 3,331,652 - - 3,331,652 362,867 20,052 45,342 428,261

originated or purchased

Derecognition of (1,486,416) - - (1,486,416) (160,675) - (43,004) (203,679)

financial assets Derecognition of (572,237) (11,524) - (583,761) (186,541) - - (186,541)

Reclassification of - - - - - financial assets

instruments Reclassification of

Write-offs - - (1,151,599) (1,151,599) - - - - instruments measured - - - - -

at FVOCI to amortised

Changes in models/risk (8,158,984) - 230,000 (7,928,984) (386,419) - - (386,419) cost

parameters Write-offs - - - - - - - -

Foreign exchange and (91,542) - (200,469) (292,011) (18,120) (1,170) (2,338) (21,628)

other movements Changes in models/risk 5,514,913 (2,962,881) 1,967,292 4,519,324 104,035 - - 104,035

parameters

Allowance 4,961,484 - 4,382,538 9,344,022 360,063 5,196 - 365,259 Foreign exchange and

at 31 December 2024 1,163,456 103,800 97,717 1,364,973 28,228 - - 28,228

other movements

Allowance 13,966,337 - 5,504,606 19,470,943 831,155 20,052 45,342 896,549

at 31 December 2023

35 BANKA KOMBËTARE TREGTARE