Page 99 - BKT Annual Report 2024 EN

P. 99

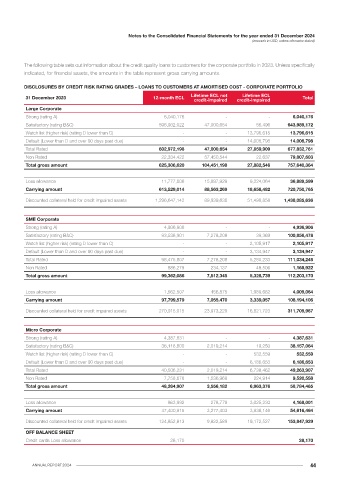

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

The following table sets out information about the credit quality of financial assets, other than loans to customers, measured at The following table sets out information about the credit quality of financial assets, other than loans to customers, measured at

amortised cost, FVOCI debt investments in 2024. Unless specifically indicated, for financial assets, the amounts in the table represent amortised cost, FVOCI debt investments in 2023. Unless specifically indicated, for financial assets, the amounts in the table represent

gross carrying amounts. gross carrying amounts.

2024 2023

Lifetime ECL not Lifetime ECL Purchased credit- Lifetime ECL not Lifetime ECL Purchased credit-

12-month ECL Total 12-month ECL Total

credit-impaired credit-impaired impaired credit-impaired credit-impaired impaired

Placements and Balances with banks at amortised cost Placements and Balances with banks at amortised cost

Aa1 to Aa3 - - - - - Aa1 to Aa3 15,497,198 - - - 15,497,198

A1 to A3 118,899,344 - - - 118,899,344 A1 to A3 124,693,889 - - - 124,693,889

Baa1 to Baa3 52,098,538 - - - 52,098,538 Baa1 to Baa3 11,061,633 - - - 11,061,633

Ba1 to Ba3 6,321,551 - - - 6,321,551 Ba1 to Ba3 16,313,184 - - - 16,313,184

B1 to B3 5,206,850 - - - 5,206,850 B1 to B3 5,530,674 - - - 5,530,674

Caa1 to Caa3 - - - - - Caa1 to Caa3 - - - - -

Unrated 30,264,327 - - - 30,264,327 Unrated 4,536,709 - - - 4,536,709

Exposure before impairment 212,790,610 - - - 212,790,610 Exposure before impairment 177,633,287 - - - 177,633,287

Loss allowance 15,504 - - - 15,504 Loss allowance 14,075 - - - 14,075

Carrying amount 212,775,106 - - - 212,775,106 Carrying amount 177,619,212 - - - 177,619,212

Loans to Banks at amortised cost Loans to Banks at amortised cost

Aa1 to Aa3 - - - - - Aa1 to Aa3 - - - - -

A1 to A3 19,793,994 - - - 19,793,994 A1 to A3 - - - - -

Baa1 to Baa3 21,458,286 - - - 21,458,286 Baa1 to Baa3 20,044,767 - - - 20,044,767

Ba1 to Ba3 64,270,575 - - - 64,270,575 Ba1 to Ba3 25,854,592 - - - 25,854,592

B1 to B3 32,169,693 - - - 32,169,693 B1 to B3 69,441,326 - - - 69,441,326

Caa1 to Caa3 1,657,125 - - - 1,657,125 Caa1 to Caa3 21,008,838 - - - 21,008,838

Unrated - - - - Unrated - - - -

Exposure before impairment 139,349,673 - - - 139,349,673 Exposure before impairment 136,349,523 - - - 136,349,523

Loss allowance 537,627 - - - 537,627 Loss allowance 1,518,985 - - - 1,518,985

Carrying amount 138,812,046 - - - 138,812,046 Carrying amount 134,830,538 - - - 134,830,538

Investment Securities at FVOCI Investment Securities at FVOCI

Aa1 to Aa3 341,116,882 - - - 341,116,882 Aa1 to Aa3 354,725,265 - - - 354,725,265

A1 to A3 173,126,168 - - - 173,126,168 A1 to A3 142,774,566 - - - 142,774,566

Baa1 to Baa3 182,145,690 - - - 182,145,690 Baa1 to Baa3 153,728,822 - - - 153,728,822

Ba1 to Ba3 567,528,562 - - - 567,528,562 Ba1 to Ba3 117,485,443 - - - 117,485,443

B1 to B3 60,820,251 - - - 60,820,251 B1 to B3 182,660,544 - - - 182,660,544

Caa1 to Caa3 - 2,053,150 3,657,165 - 5,710,315 Caa1 to Caa3 - 13,098,912 - - 13,098,912

Unrated 6,094,777 - 28,434,728 - 34,529,505 Unrated 108,346,429 - 5,954,458 - 114,300,887

Rating Withdrawn - - - Rating Withdrawn - - 24,866,118 24,866,118

Exposure before impairment 1,330,832,330 2,053,150 32,091,893 - 1,364,977,373 Exposure before impairment 1,059,721,069 13,098,912 30,820,576 - 1,103,640,557

Loss allowance - - - - - Loss allowance - - - - -

Carrying amount 1,330,832,330 2,053,150 32,091,893 - 1,364,977,373 Carrying amount 1,059,721,069 13,098,912 30,820,576 - 1,103,640,557

Investment Securities at Amortised Cost Investment Securities at Amortised Cost

Aa1 to Aa3 226,223,683 - - - 226,223,683 Aa1 to Aa3 120,542,820 - - - 120,542,820

A1 to A3 121,000,889 - - - 121,000,889 A1 to A3 122,966,551 - - - 122,966,551

Baa1 to Baa3 184,304,484 - - - 184,304,484 Baa1 to Baa3 262,813,211 - - - 262,813,211

Ba1 to Ba3 1,521,940,270 - - - 1,521,940,270 Ba1 to Ba3 130,128,225 - - - 130,128,225

B1 to B3 34,147,451 - - - 34,147,451 B1 to B3 1,530,743,067 - - - 1,530,743,067

Caa1 to Caa3 - - - - - Caa1 to Caa3 - - - - -

Unrated 14,604,651 - 4,629,689 - 19,234,340 Unrated 28,744,128 - 3,563,310 - 32,307,438

Rating Withdrawn - - - - - Rating Withdrawn - - 2,419,402 - 2,419,402

Exposure 2,102,221,428 - 4,629,689 - 2,106,851,117 Exposure 2,195,938,002 - 5,982,712 - 2,201,920,714

Loss allowance 11,674,239 - 4,382,538 - 16,056,777 Loss allowance 25,598,712 - 5,504,606 - 31,103,318

Carrying amount 2,090,547,189 - 247,151 - 2,090,794,340 Carrying amount 2,170,339,290 - 478,106 - 2,170,817,396

ANNUAL REPORT 2024 42