Page 101 - BKT Annual Report 2024 EN

P. 101

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

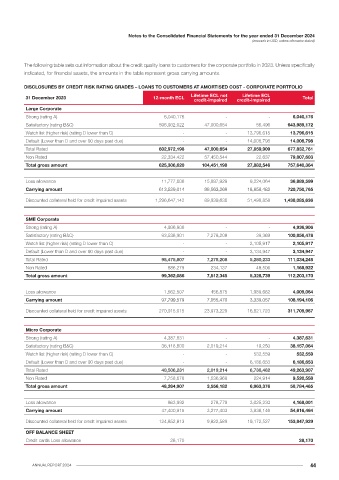

The following table sets out information about the credit quality loans to customers for the corporate portfolio in 2024. Unless specifically The following table sets out information about the credit quality loans to customers for the corporate portfolio in 2023. Unless specifically

indicated, for financial assets, the amounts in the table represent gross carrying amounts. indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST - CORPORATE PORTFOLIO DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST - CORPORATE PORTFOLIO

Lifetime ECL not Lifetime ECL Lifetime ECL not Lifetime ECL

31 December 2024 12-month ECL Total 31 December 2023 12-month ECL Total

credit-impaired credit-impaired credit-impaired credit-impaired

Large Corporate Large Corporate

Strong (rating A) 13,416,991 - - 13,416,991 Strong (rating A) 6,040,176 - - 6,040,176

Satisfactory (rating B&C) 609,152,404 33,549,977 7,296 642,709,677 Satisfactory (rating B&C) 596,932,022 47,000,654 56,496 643,989,172

Watch list (higher risk) (rating D lower than C) - - 3,371,367 3,371,367 Watch list (higher risk) (rating D lower than C) - - 13,796,615 13,796,615

Default (Lower than D and over 90 days past due) - - 20,137,139 20,137,139 Default (Lower than D and over 90 days past due) - - 14,006,798 14,006,798

Total Rated 622,569,395 33,549,977 23,515,802 679,635,174 Total Rated 602,972,198 47,000,654 27,859,909 677,832,761

Non Rated 47,464,354 37,600,623 - 85,064,977 Non Rated 22,334,422 57,450,544 22,637 79,807,603

Total gross amount 670,033,749 71,150,600 23,515,802 764,700,151 Total gross amount 625,306,620 104,451,198 27,882,546 757,640,364

Loss allowance 8,553,773 9,886,366 14,558,884 32,999,023 Loss allowance 11,777,606 15,887,929 9,224,064 36,889,599

Carrying amount 661,479,976 61,264,234 8,956,918 731,701,128 Carrying amount 613,529,014 88,563,269 18,658,482 720,750,765

Discounted collateral held for credit impaired assets 1,510,164,213 101,482,257 37,207,989 1,648,854,459 Discounted collateral held for credit impaired assets 1,296,647,142 89,939,636 51,498,858 1,438,085,636

SME Corporate

SME Corporate

Strong (rating A) 4,936,906 - - 4,936,906

Strong (rating A) 52,963,985 155,060 - 53,119,045

Satisfactory (rating B&C) 93,538,901 7,278,208 39,369 100,856,478

Satisfactory (rating B&C) 86,646,649 5,435,915 37,592 92,120,156

Watch list (higher risk) (rating D lower than C) - - 2,105,917 2,105,917

Watch list (higher risk) (rating D lower than C) - - 2,272,179 2,272,179

Default (Lower than D and over 90 days past due) - - 3,134,947 3,134,947

Default (Lower than D and over 90 days past due) - - 6,926,729 6,926,729

Total Rated 98,475,807 7,278,208 5,280,233 111,034,248

Total Rated 139,610,634 5,590,975 9,236,500 154,438,109

Non Rated 886,279 234,137 48,506 1,168,922

Non Rated 1,645,052 15,301 172,372 1,832,725

Total gross amount 99,362,086 7,512,345 5,328,739 112,203,170

Total gross amount 141,255,686 5,606,276 9,408,872 156,270,834

Loss allowance 1,562,507 456,875 1,989,682 4,009,064

Loss allowance 1,736,609 321,166 3,456,253 5,514,028

Carrying amount 97,799,579 7,055,470 3,339,057 108,194,106

Carrying amount 139,519,077 5,285,110 5,952,619 150,756,806

Discounted collateral held for credit impaired assets 270,915,015 23,973,229 16,821,723 311,709,967

Discounted collateral held for credit impaired assets 379,133,218 19,243,917 27,085,654 425,462,789

Micro Corporate

Micro Corporate Strong (rating A) 4,387,631 - - 4,387,631

Strong (rating A) 13,610,410 13,290 - 13,623,700

Satisfactory (rating B&C) 36,118,600 2,019,214 19,250 38,157,064

Satisfactory (rating B&C) 45,943,738 2,470,538 11,913 48,426,189 Watch list (higher risk) (rating D lower than C) - - 532,559 532,559

Watch list (higher risk) (rating D lower than C) - - 798,369 798,369 Default (Lower than D and over 90 days past due) - - 6,186,653 6,186,653

Default (Lower than D and over 90 days past due) - - 3,968,262 3,968,262 Total Rated 40,506,231 2,019,214 6,738,462 49,263,907

Total Rated 59,554,148 2,483,828 4,778,544 66,816,520 Non Rated 7,758,676 1,536,968 224,914 9,520,558

Non Rated 6,783,456 105,860 892,204 7,781,520 Total gross amount 48,264,907 3,556,182 6,963,376 58,784,465

Total gross amount 66,337,604 2,589,688 5,670,748 74,598,040

Loss allowance 863,992 278,779 3,025,230 4,168,001

Loss allowance 942,595 171,633 2,429,583 3,543,811 Carrying amount 47,400,915 3,277,403 3,938,146 54,616,464

Carrying amount 65,395,009 2,418,055 3,241,165 71,054,229

Discounted collateral held for credit impaired assets 124,852,813 9,822,589 19,172,527 153,847,929

Discounted collateral held for credit impaired assets 168,533,352 10,444,456 16,534,674 195,512,482

OFF BALANCE SHEET

OFF BALANCE SHEET Credit cards Loss allowance 28,170 28,170

Credit cards Loss allowance 39,496 39,496

ANNUAL REPORT 2024 44