Page 107 - BKT Annual Report 2024 EN

P. 107

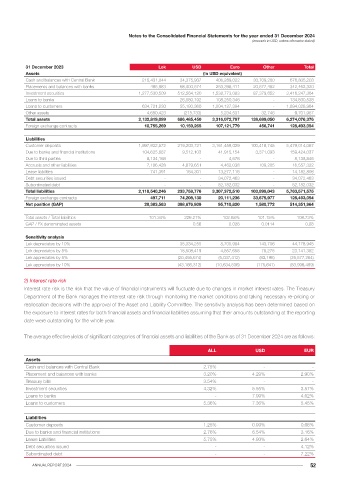

Notes to the Consolidated Financial Statements for the year ended 31 December 2024 Notes to the Consolidated Financial Statements for the year ended 31 December 2024

(amounts in USD, unless otherwise stated) (amounts in USD, unless otherwise stated)

As at 31 December 2024, the Bank’s monetary assets and liabilities have remaining contractual maturities as follows:

v. Concentrations of credit risk

The Bank monitors concentrations of credit risk by sector and by geographic location. An analysis of concentrations of credit risk from

loans and investment securities as of 31 December 2024 and 31 December 2023 is shown below: Up to 1 month 1-3 months 3-12 months 1-5 years Over 5 years Total

Assets

Cash and balances with Central Bank 677,670,397 - - - - 677,670,397

Loans to customers Loans to banks Investment Securities

Note 31 December 31 December 31 December 31 December 31 December 31 December Placement and balances with banks 299,808,659 1,142,520 36,825,922 - - 337,777,101

2024 2023 2024 2023 2024 2023 Investment securities 208,693,339 302,759,068 604,446,663 1,838,835,579 700,515,482 3,655,250,131

Carrying amount 9,10,11 1,909,046,482 1,694,028,984 138,812,046 134,830,538 3,655,250,131 3,416,247,364 Loans to banks 5,056,327 1,847,644 75,732,359 41,854,864 14,320,852 138,812,046

Loans to customers 79,121,788 64,342,535 402,408,899 766,204,922 596,968,338 1,909,046,482

Concentration by sector Other assets 13,502,965 - - - - 13,502,965

Corporate 953,218,780 882,738,293 5,208,352 3,396,419 264,469,254 360,933,122 Total assets 1,283,853,475 370,091,767 1,119,413,843 2,646,895,365 1,311,804,672 6,732,059,122

Government 253,887 794,872 2,623,828 4,692,563 2,762,204,215 2,480,597,956

Banks - - 130,979,866 126,741,556 628,576,662 574,716,286 Liabilities

Retail 955,573,815 810,495,819 - - - - Customer deposits 3,249,362,611 312,366,297 1,320,319,255 816,320,293 49,286,427 5,747,654,883

Total 1,909,046,482 1,694,028,984 138,812,046 134,830,538 3,655,250,131 3,416,247,364

Due to banks and financial institutions 206,502,949 3,052,738 27,396,964 14,634 - 236,967,285

Due to third parties 3,812,079 - - - - 3,812,079

Loans to customers Loans to banks Investment Securities

Concentration by Note Accruals and other liabilities 18,987,089 - - - 758,452 19,745,541

location 31 December 31 December 31 December 31 December 31 December 31 December Lease liabilities 215,201 426,685 1,803,683 5,729,123 5,780,483 13,955,175

2024 2023 2024 2023 2024 2023

Debt securities issued - - 317,233 63,225,843 - 63,543,076

Albania 1,037,717,997 978,277,354 - - 1,878,983,856 1,661,623,750

Subordinated debt - - 26,188,782 - 22,907,914 49,096,696

Kosovo 809,181,479 670,879,294 - - 76,208,422 39,803,280 Total liabilities 3,478,879,929 315,845,720 1,376,025,917 885,289,893 78,733,276 6,134,774,735

Europe 37,119,791 11,584,104 102,653,977 89,655,048 1,181,407,971 1,119,504,537 Net Position (2,195,026,454) 54,246,047 (256,612,074) 1,761,605,472 1,233,071,396 597,284,387

Asia - - 5,035,232 3,613,272 138,345,594 219,772,164 Cumulative Net Position (2,195,026,454) (2,140,780,407) (2,397,392,481) (635,787,009) 597,284,387 -

Middle East and Africa - - 31,122,837 41,562,218 130,895,250 124,531,273

America 25,027,215 33,288,232 218,651,391 221,243,815

Australia - - - - 30,757,647 29,768,545 LRM reports are produced for each single currency Lek, Euro and USD and for the total statement of financial position as well. Maximum

Total 9,10,11 1,909,046,482 1,694,028,984 138,812,046 134,830,538 3,655,250,131 3,416,247,364 cumulative outflow limits, which are managed and monitored on a daily-basis, have been assigned for each of the above currencies.

(c) Liquidity risk As of 31 December 2023, the Bank’s monetary assets and liabilities have remaining contractual maturities as follows:

Liquidity risk is the risk that the Bank will encounter difficulty in meeting obligations associated with its financial liabilities that are Up to 1 month 1-3 months 3-12 months 1-5 years Over 5 years Total

settled by delivering cash or another financial asset. The purpose of Liquidity Risk Management (LRM) is to ensure, as far as possible, Assets

that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring Cash and balances with Central Bank 676,805,203 - - - - 676,805,203

unacceptable losses or risking damage to the Bank’s reputation. Bank’s LRM policy includes how the Bank identifies, measures,

monitors and controls that risk. Placement and balances with banks 253,190,785 52,069,783 37,201,752 - - 342,462,320

Investment securities 301,651,950 346,903,166 504,536,596 1,817,493,361 445,662,291 3,416,247,364

Organization of LRM: Bank’s LRM Organization includes two different bodies in the monitoring and management of liquidity. The Loans to banks 2,207,756 - 80,699,254 37,712,049 14,211,479 134,830,538

involvement of different bodies helps provide clear allocation of the responsibility for monitoring/reporting and management of Liquidity Loans to customers 70,263,128 47,928,175 377,116,267 688,165,772 510,555,642 1,694,028,984

Risk. Day-to-day management of liquidity belongs to the Treasury Group but day-to-day monitoring of Liquidity risk and compliance to Other assets 9,701,967 - - - - 9,701,967

the limits belongs to the Risk Management Group. The main purpose of the Risk Management Group, which conducts daily overview Total assets 1,313,820,789 446,901,124 999,553,869 2,543,371,182 970,429,412 6,274,076,376

of LRM reports, is to provide an early warning signal of liquidity risk to the senior management of the Bank.

Liabilities

LRM Reports: Bank’s LRM policy includes sets of daily and monthly reports to be reviewed and monitored by Market Risk Department. Customer deposits 3,037,197,834 284,653,010 1,224,118,500 879,319,670 53,725,053 5,479,014,067

Daily reports include Maximum Cumulative Outflow table and Cumulative Assets and Liabilities Breakdown table, which control

respectively daily and monthly inflows/outflows of liquidity till 1-year maturity under “business as usual” scenario. Monthly reports Due to banks and financial institutions 148,959,097 - 10,453,903 11,037 - 159,424,037

include stress testing liquidity breakdown tables, which control daily and monthly inflows/ outflows of liquidity under separate bank Due to third parties 8,138,846 - - - - 8,138,846

specific and market specific crisis scenarios till 3-months maturity. Accruals and other liabilities 15,807,527 - - - 749,795 16,557,322

Lease liabilities 218,590 438,703 1,892,511 5,639,327 5,993,677 14,182,808

The LRM approach of the Bank results in positive liquidity gaps for all time stages up to one year as at 31 December 2024. This resulted Debt securities issued - - 101,912 33,970,551 - 34,072,463

mainly because of the following three assumptions: Subordinated debt - - 208,857 27,645,306 24,327,869 52,182,032

• Using statistical method and historical data (derived since 2001), the actual LRM reports include analysis into the behavioural Total liabilities 3,210,321,894 285,091,713 1,236,775,683 946,585,891 84,796,394 5,763,571,575

re-investment pattern of deposits; Net Position (1,896,501,105) 161,809,411 (237,221,814) 1,596,785,291 885,633,018 510,504,801

• Short term securities available for sale are considered liquid through the secured funding from Bank of Albania; Cumulative Net Position (1,896,501,105) (1,734,691,694) (1,971,913,508) (375,128,217) 510,504,801 -

• Bank’s reserve requirements held with BoA are considered as non-liquid assets.

An analysis of the Bank’s expected timing of cash flows by simple remaining maturity is shown in the following tables.

ANNUAL REPORT 2024 50